So, you just leased or bought a NinjaTrader® 8 lifetime license. Smart move, if you’re serious about day trading Futures.

But now… you’re staring down the barrel of a question every user starting NinjaTrader® has to face.

Which indicators should you load on your chart (and which should you avoid) to win your way, anyway?

Would you like to dramatically shorten your intraday futures learning curve…

Want to know how to save hundreds of hours of painstaking, trial-and-error testing of the best indicators for futures traders…

If so, you’ve come to the right place, trader!

Here's a look at the best of the best types of indicators for day trading futures. With examples of both default NT8 indicators and, of course, some of the most popular indicators.

So buckle up and let dive into the following categories of intraday indicators you definitely want on your charts.

Cash In with Supply and Demand

Just as in all other free-market transactions, the laws of supply and demand (SD) weigh heavily on the price evolution of every futures market. You must know if your chosen market is relatively cheap or expensive, watching your chart for confirmation of stalls or trend reversals at such extreme valuations.

Figure 1.) Our Supply and Demand Pro tools for NT8 can help you rake in the green, session after session.

Often, a tell-tale sign of a future reversal zone is a combination of wide-range, high-volume bars that print after a sustained swing or trend move. Almost without fail, the next time that price moves into that zone, it will stall (a profit taking area) or it will strongly react, setting off a major trend reversal that you can latch on to.

When you know - in advance - the precise location of each and every key SR level, you’ll be miles ahead of the typical, often clueless retail trader. You know, the ones that end up as intraday institutional roadkill.

Figure 2.) The Ninjacators Supply and Demand Trader software for NT8 helps you pinpoint your trade entries and exits at all key reversal points.

You can easily ID such potential SD zones by using NT8's volume histogram and ATR indicators to prepare for potentially powerful reversal opportunities. Alternatively, you can plot trend lines, Fibonacci grids, and other key drawing tools that make your job of locating prime SD turning points fast and easy.

Grab Big Profits with Opening Gaps

Most futures markets trade virtually round-the-clock from Sunday night until Friday afternoon.

However, since the vast majority of trading volumes occur from 0930 to 1615 (M-Fr), there is often a noticeable 'gap' between yesterday’s closing price and today's retail open price (930 ET for stock index futures).

Figure 3.) The Smart Gap Trader for NT8 can help you ace the never-ending opportunities that opening gaps offer, day after day.

For enterprising day traders, this can be a prime, one-strike opportunity to capture a fast profit, as hundreds of thousands of orders simultaneously flood into the market. Get positioned in advance on the 'right' side of the anticipated gap-closing move, and your trading day can be a done deal within a few minutes.

Whenever you see your futures market open noticeably higher or lower than where it closed yesterday (retail session), you can get positioned for a fast reversion move as institutions attempt to bring price back into line.

Key NT8 technicals for this task include Camarilla and floor trader pivots, Fibonacci retracements, candlestick patterns, Keltner and Bollinger bands, volume profile histograms, and moving averages.

The big idea is to fade (trade against) the open gap, using any and all of the above tools to help you find a solid 'backstop' to support your trade.

If successful, you'll witness the power of mean reversion as the gap closes, profits pour into your account, and you walk away a winner.

Price Patterns You Can Make Bank On

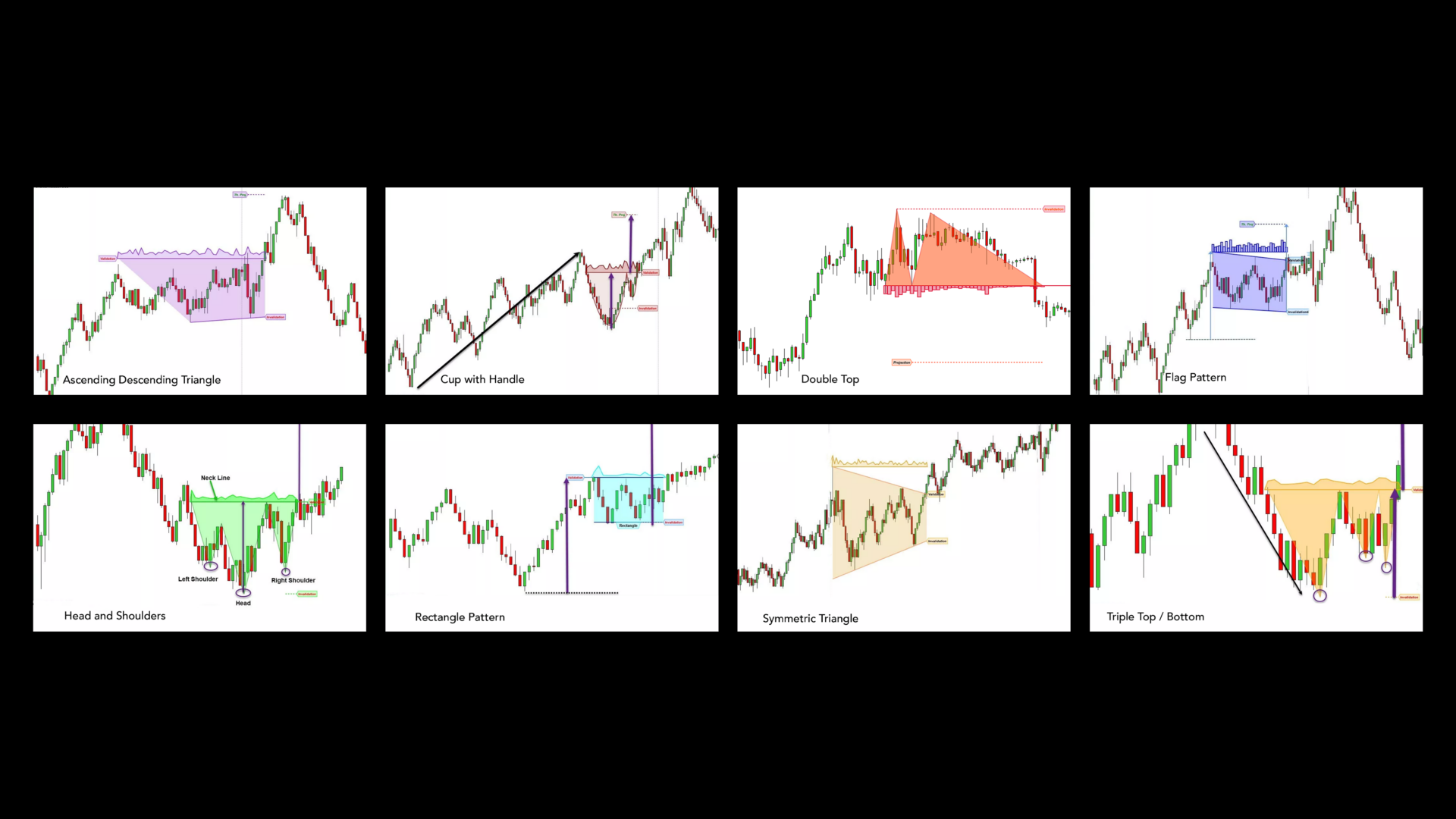

Many successful day traders rely on classic price patterns to enter and exit their trades.

Such formations include pennants, rectangles, head-and-shoulders, double/triple tops and bottoms, cup and handles, and flags.

Figure 4.) Let Pure Pattern Trader and its specialized algos plow profits into your trading account..

The beauty of most patterns is that each one forecasts logical stop and price targets, so you always know where to enter, exit, and take profits.

Why aren’t you availing yourself of this for your own trading account?

Software can now automatically scan for each pattern variety, and in real-time for the markets you trade, thus saving your hours of visual scanning. Even better, the algos that scan and plot your patterns can also give you automated buy and sell signals, helping you avoid ‘analysis paralysis.’

Trend lines, a basic component of all price patterns, come standard in your NT8 platform, and can be plotted automatically for you.

Go With the Order Flow

Order flow tools are yet another must-have for your day trading tool chest. At a glance, you can determine high probability stall, reversal, and continuation price zones – in advance of price getting there.

Imagine having the confidence to stay with your intraday swing trades for max gains, rather than cutting them short. With the right order flow tools, you can make that a reality, session after session.

Figure 5.) Our unique Order Flow Advantage software for NT8 will help you stay in winning trades longer, day after day.

Volume profile is the most important order flow tool, as it frequently acts as an intraday line in the sand, keeping you on the right side of the market. For example, look for easy-to-spot volume 'holes' on either side of a long, thin, volume profile histogram peak; as price either reverses off or breaks through the histogram peak, expect a rapid move to the next area of volume concentration.

Volume weighted average price (VWAP) is another 'must have' indicator for your day trading operation. Many institutional algorithms enter/exit the market at or near the current VWAP line, even as others base their trading decisions on price being overextended from the VWAP.

Cumulative delta shows you the relative accumulation and distribution of all market participants, and is very useful in identifying divergences and impending market reversals.

NT8 comes standard with a complete suite of order flow tools, getting you up to speed quickly, even if you're a new trader.

Strike Gold with Volatility Breakout Trading

Surely, you've witnessed the absolute volatility explosion that happens right after 1400 hrs on FOMC meeting day.

Figure 6.) The High Probability Breakout plug-in for NT8 will enable you to cash in on explosive volatility expansion moves - that happen every trading session.

Typically, the ES, NQ, ZB, and other key futures markets will go crazy for the next 15-30 minutes, as traders attempt to make sense of the latest Fed interest rate decision. If you position yourself wisely as the volatility increases, you might grab some healthy profits as fast, sustained price surges play out.

With the right tools to scan for intraday setups, you too, can snag your fair share of each trading session’s breakout bonanza.

NT8 comes standard with several useful volatility breakout measures, including:

Average True Range (ATR)

Bollinger Bands

Darvas Box

Keltner Bands

Breakouts from small-range, narrowing, low-volatility patterns (wedges, pennants) typically occur with volatility expansion, and can also plow profits into your account..

Trade the News and Grab Your Share of Gains

Every day, key news events and government reports hit the wires, often precipitating powerful, potentially profitable price surges in the markets you trade.

Stock index, energy, interest rate, currency, metals, and agricultural futures markets are all fair game for aggressive profit takers who get positioned correctly.

Are you ready to join their elite ranks today?

Figure 7.) The Ninjacators Scheduled News Trading add-on for NT8 not only gives you a heads-up before the news hits, it also gives you a systematic plan to capture killer profits..

You don’t even have to speculate on which way a market might move before the news hits, even though that’s often a profit maker. Instead, you can wait until other traders are done over-reacting to the news, jumping in to catch high-probability mean reversion moves as the report buzz fades out.

NT8 comes with a News widget to assist in keeping you abreast of upcoming reports and the headlines that impact the markets you trade. Simply select the market, add the desired keywords, and the tool will deliver the news as it's released.

How to Get Started Right Now

Certainly, the above list isn’t the be-all or end-all as to which indicators you’ll need for your futures day trading regimen.

Your trading plan is, after all, as unique as you are.

Regardless, indicators falling within the parent categories of supply and demand, opening gaps, price patterns, order flow, volatility breakout, and news events will provide you with tools that professional traders rely on every trading session.

In fact, you can even join 50,000 other licensed NinjaTrader® users who get a 100% FREE indicator from us every single month. By signing up for our free Indicator of the Month Club.

Each month you get a wildly popular indicator with step-by-step quick start videos. Along with our best trading strategy you can start profiting from as soon as your next session.So no matter if you choose to use NinjaTrader’s® default indicators, our free or even paid ones here in the store, you’ll now have what you need to prosper faster on NinjaTrader®.